General

What is LoanSnap?

LoanSnap is a mortgage lender that provides solutions based on your entire financial situation. We look beyond just the lowest interest rates for your best option. You might have student loans or credit cards and those will factor into your overall monthly payments. We show you where you are and where you could be so you can stop losing money and get the best refinance, home equity line of credit or mortgage for your specific financial situation.

What is a “smart loan”?

A smart loan is just what it sounds like, a loan that is smart. It factors in your monthly bills, including credit cards and student loans, to get the best home loan for you. With a clear view of your situation, you can see where you’re losing money every month and get a home loan that helps you put more money in your wallet.

What is LoanSnap’s mission?

LoanSnap’s mission is to improve every American’s financial situation. Finances can be overwhelming and cause incredible amounts of stress. We hope to bring relief to people who need some help making sense of a confusing system.

How am I losing money?

The interest rates on your credit cards, student loans or car loans are likely much higher than the interest rate on your mortgage. Most people don’t realize they can move their credit cards or loans to their mortgage and save thousands in interest payments. Other lenders only focus on interest rates because it is easier to do, but their customers end up losing money by not getting a full view of their finances.

Where is LoanSnap available?

We are currently available in AL, AR, AZ, CA, CO, FL, GA, IA, ID, IL, IN, KS, LA, MD, MI, NE, NH, NJ, NM, OH, OK, OR, PA, SC, SD, TN, TX, WA, and WI. If you live outside these states, we are expanding as fast as we can and hope to be available in your state soon! Let us know which state you want next at info@goloansnap.com!

Is LoanSnap safe to use?

Keeping your information secure and private is a top priority for us. See our Privacy Policy for more information. We have funded people throughout CA, IL and FL and follow all federal and state level legal guidelines around lending. You can see our licenses and disclosures here.

In 2018, we acquired DLJ Financial bringing 21 years of mortgage lending and expertise to the company. You can read customer reviews on TrustPilot here.

What is APR/APY?

APR stands for Annual Percentage Rate. It is the annual rate that is either charged for borrowing money or returned through an investment. It does not factor in compounding interest.

APY is the Annual Percentage Yield. It factors in both the interest rate and compounding interest that occurs. Compounding occurs when interest is earned on and then added to a balance during the next compounding cycle, interest is calculated on the new balance.

What types of properties does LoanSnap cover?

We currently cover single family homes and condos. We do not cover mobile homes or commercial properties at this time.

Does LoanSnap offer personal loans?

No, we only offer mortgages, mortgage refinances and HELOCs.

What is an appraisal and why do I need it?

An appraisal occurs during the closing process of a home purchase or refinance to determine the value of the home. It is usually ordered by the lender so they can make sure the homebuyer or refinancer is not over borrowing. An appraiser will visit the home and inspect inside and outside to determine the value. They will also compare the property against similar homes in the area that have sold recently. If an appraisal comes in under the contract price, the lender will only lend what the home is worth and the transaction may be delayed. If the appraisal comes in at or over the contract price, the closing process will continue. All appraisals are done by a 3rd party. Federal law regulates that appraisers must be impartial and have no interest in the transaction.

Products

What is refinancing?

There are two standard types of refinancing:

A rate-and-term refinance allows you to replace your current mortgage with a new one that lowers your monthly payments.

A cash out refinance lets you unlock the value of your home and provides you with cash in hand for anything you may need.

Refinancing may be right for you if you’re hoping to save money and lower your monthly mortgage payments. Answer a few questions to see what options we have for you: Get Started

What is a home equity loan or line of credit (HELOC)?

Home equity is the homeowner’s interest in their home: the market value of the home minus the outstanding amount on the mortgage. A home equity loan is a loan taken out of the available home equity that is provided in one lump sum. A HELOC works like a credit card where you can use a certain amount of money each month, but credit is taken from your home equity instead of from a bank or other lender.

We currently offer HELOCs and may offer Home Equity loans in the future.

Does LoanSnap offer VA, FHA and Non-conforming loans?

Yes, we offer FHA, VA and Non-conforming loans.

FHA loans are insured by the Federal Housing Administration and have more lenient credit score and down payment requirements than most conventional loans.

VA loans are for United States veterans. They allow veterans to purchase a home with no down payment and without private mortgage insurance.

Non-conforming loans are loans that can be funded by private sources outside typical agencies like Fannie Mae and Freddie Mac.

Application

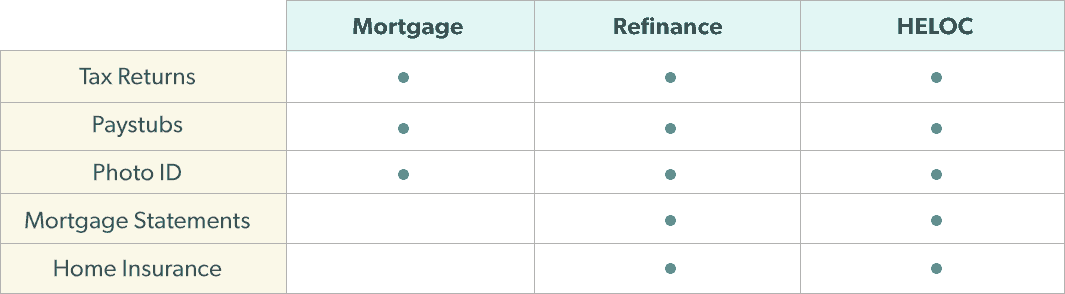

What documents are needed for approval

Most applications will require the following forms:

We only request documents that are absolutely needed. If you have experienced or fall under any of the following, we may need additional paperwork: undergone a name change, are self-employed, have gone through a divorce or own a property with liens. These documents are to ensure our mortgage recommendations are the best we can offer you.

Where can I find the status of my application?

Please call us at 949-236-5134 for the latest status on your application.

My loan was funded, why have I not received it?

It can take anywhere from 3 – 8 business days from funding to receipt of funds. Mailed checks typically take 3 – 8 business days to arrive and wire transfers can take 1 – 3 business days. If you still haven’t received anything after 8 business days, please call us at 949-236-5134.

Support

I didn't find the answer to my question, how can I reach you?

Call us at 949-236-5134.

Careers

How can I work for LoanSnap?

We’re always looking for talented people! See what open positions we have here.