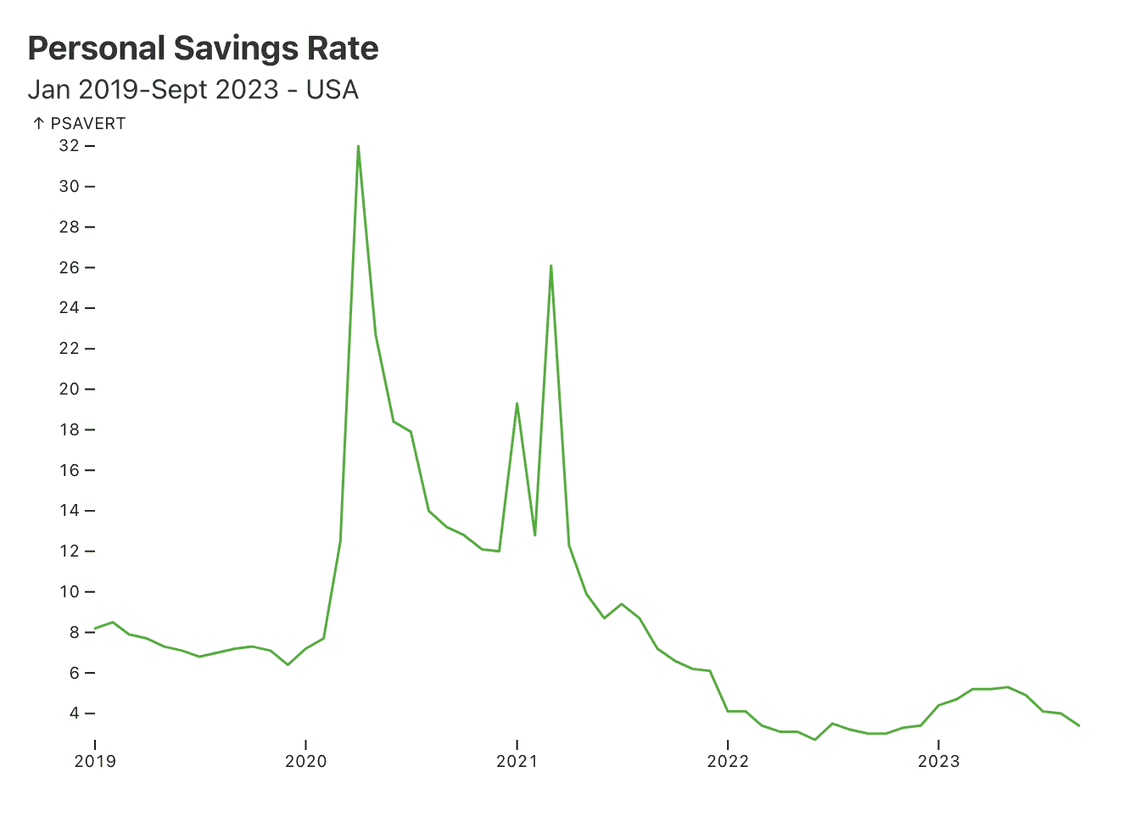

US Personal Savings Rate Drops to 3.4%

September is the lowest level of 2023.

Last month we saw the personal savings rate fall to its lowest level of 2023. That trend continued this week with the St Louis Fed released the latest data from September. While income and home equity remain historically high, consumers are not changing behaviors to save more money each month.

In the economic landscape of the United States, the personal savings rate has long been a barometer for gauging consumer sentiment, financial health, and macroeconomic trends.

In 2019, the year started with a moderate savings rate of 8.2% in January. This level reflected a balanced economy, with a mix of consumer spending and saving. However, as the months rolled by, the national mood slightly shifted. By December, the savings rate had declined to 6.4%, pointing to potential macroeconomic pressures or increased consumer confidence leading to greater spending.

2020, however, brought with it unexpected economic challenges. The early months were marked by a palpable sense of uncertainty. By March, the national savings rate had surged to 12.5%. This sudden inclination towards saving was indicative of consumer apprehension regarding future income and employment prospects. The rate's escalation to a staggering 32% in April bore the hallmarks of a significant liquidity trap. Americans, faced with an uncertain economic future, chose to hoard cash rather than invest or spend.

Yet, the latter part of 2020 saw a gradual return of consumer confidence, and savings rates began to stabilize, settling around 12% by year's end.

2021 was marked by resilience and adaptability. A sharp rise to 26.1% in March savings rate might reflect exogenous shocks or policy adjustments. Nevertheless, the rate's decline over the ensuing months, culminating in a 6% rate by December, suggested an economic recalibration and possibly an uptick in consumer sentiment.

2022 exhibited relative stability in the face of prior volatility. With national savings rates demonstrating minor fluctuations between 2.7% and 4.1%, it seemed the U.S. economy had found a new equilibrium. The behavior of Americans during this period resonated with the Permanent Income Hypothesis, wherein consumption and savings were primarily influenced by long-term income expectations.

Entering 2023, with savings rates averaging around 5%, it became evident that the nation was moving in line with the Economic Life Cycle Hypothesis. Individuals appeared to be adjusting their savings and consumption patterns based on life stages and anticipated future income.

In analyzing these trends, it becomes clear that the personal savings rate of the United States offers a multifaceted lens through which one can view national economic health, policy effectiveness, and consumer sentiment. The years 2019 to 2023 underscore the interplay of micro-level behaviors and macro-level phenomena in shaping the country's economic narrative.