Privately Owned Housing Starts Accelerate in November

New housing starts show strong growth, give optimism for December and into 2024.

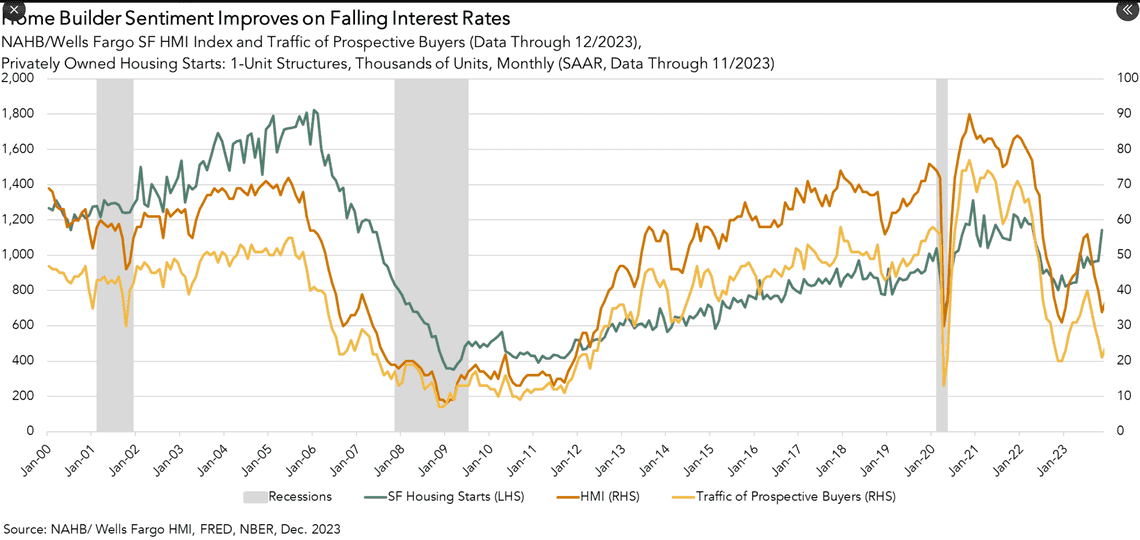

We're going to delve into the current dynamics of the housing market, focusing on recent trends in housing starts and builder sentiment. Let's start with some fresh data from November.

In the month, privately-owned housing starts were at a seasonally adjusted annual rate of 1.56 million. Now, what does this number mean in context? It exceeded consensus expectations, which were pegged at 1.36 million. This figure represents a significant 14.8% increase from the revised October estimate of 1.359 million, and it's also 9.3% higher than the rate we observed in November of the previous year, which stood at 1.427 million.

Let's break this down further. If we focus specifically on single-family housing starts, the rate in November was 1.143 million. This shows an 18% jump from the revised October figure of 969,000. One of the key drivers behind this increase in single-family homebuilding was the lower interest rates we observed in November.

Moving on to homebuilder sentiment, there was a notable shift at the end of the year. After a period of decline, sentiment increased for the first time in five months. This positive change is attributed to falling mortgage rates, which spurred a rise in prospective buyer traffic and improved sales expectations.

Now, let's hear from an expert in the field. Robert Dietz, the Chief Economist at the National Association of Home Builders, made an interesting observation. He stated, 'The housing market appears to have passed peak mortgage rates for this cycle, and this should help to spur home buyer demand in the coming months.' This statement reflects a general optimism about the future of the housing market.

Despite this optimism and the recent decline in financing costs, it's important to note that 60% of developers are still offering incentives to stimulate demand. In December, 36% of builders reported reducing their prices, a figure that ties with the previous month as the highest percentage of the year.

Before we conclude, I'd like to acknowledge the original source of this information. The initial story was reported by Odeta Kushi, to whom we owe thanks for these insights.

Let's take a moment now to discuss these trends. What do they indicate about the overall health of the housing market? And how might they impact future housing policies and economic forecasts?

- Stew