Latest Personal Savings Rate - Despair or Not?

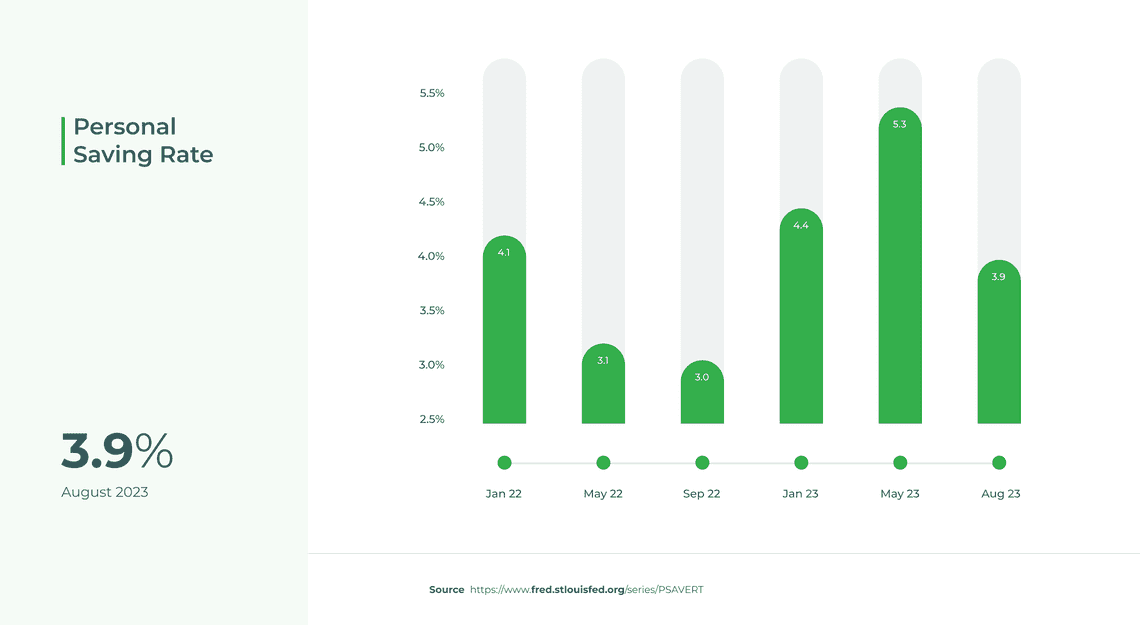

Latest Personal Savings Rate - 3.9%. Does this point to consumer erosion, or is the consumer still strong?

The personal savings rate for US consumers has dropped to its lowest level in 2023, according to the latest data released by the St. Louis Fed. While the 3.9% savings rate is above levels we saw in 2022, it could point to erosion of consumer health amongst an environment of sustained inflation, rising interest rates, and growing total consumer debt levels.

For context, the last full calendar year before the pandemic in 2019 this savings rate was 7.2%. Pulling further back the 10 years from 2010-2019 the rate was also 7.2%.

The personal savings rate is calculated as the ratio of personal savings to disposable personal income. It is a measure of how much money consumers are saving relative to their income. A higher savings rate indicates that consumers are saving more money, which can be a sign of a healthy economy.

Clearly, the US consumer has not fully recovered from the pandemic shock of 2020, and subsequent collateral and not-directly-related events in 2021, 2022, and 2023. This concerns economists around the world. The latest perspectives point to potential future problems: reduced consumer spending, higher debt levels, rising bankruptcies.

There is an argument to be made that the US consumer is in a historically healthy state, especially coming out of a recent recession. US real estate equity values are at a historically high level, as written by Conor Sen. He points out:

- Household net worth is near a record high, driven by the surge in home values during the pandemic.

- Consumers are feeling confident about their home equity, even if they are not using it to tap for cash.

- Lower-income consumer spending has remained strong, with retailer same-store sales up for companies whose stores tend to be in lower-income communities.

- The labor market is still strong, with wage growth above pre-pandemic levels.

This bolsters the argument that worries about the health of the consumer are premature and that economic growth is likely to remain resilient, even if it slows from its torrid third-quarter pace.

So there may be a bullish path forward for the American consumer and the US economy.

Stew Langille